Why RBI kept its repo rate unchanged and what it means for inflation

The six-member Monetary Policy Committee (MPC) of the Reserve Bank of India in a unanimous decision kept the repo rate unchanged at 6.50 per cent – the third consecutive time that the committee has done so. Experts have praised the central bank’s balanced approach in the face of the difficult task o

The Reserve Bank of India makes its pronouncements on its monetary policy every two months.

The Reserve Bank of India on Thursday decided to keep its policy rate unchanged.

The six-member Monetary Policy Committee (MPC) in a unanimous decision kept the repo rate unchanged at 6.50 per cent.

This is the third consecutive time that the committee has done so.

Related Articles

But what is the monetary policy? And what happened exactly? And what does this mean for inflation?

Let’s take a closer look:

What is it?

According to Investopedia, monetary policy is a set of tools deployed by a central bank.

These can control the overall money supply and promote economic growth as well as employ strategies such as revising interest rates and changing bank reserve requirements.

According to News18, the RBI makes its pronouncements on its monetary policy every two months. But during extraordinary circumstances a monetary policy review can occur at any time.

This is known as the ‘off-cycle monetary policy review’. Such a review occurred in May 2022 when inflation was too high for comfort.

The monetary policy is used to regulate price hikes as well as control India’s exchange rate.

The RBI uses a slew of instruments including repo rate, reverse repo rate, statutory liquidity ratio, cash reserve ratio, to do so.

To control inflation, the RBI uses the repo rate – the rate at which the country’s central bank lends money to all commercial banks.

The term repo refers to repurchasing option or repurchase agreement.

What happened?

The central bank decided to keep policy rate unchanged for third time in a row as it maintains a heightened vigil on inflation.

The rate increase cycle was paused in April after six consecutive rate hikes aggregating to 250 basis points since May 2022.

India has raised rates by 250 basis points (bps) since May 2022 in a bid to cool surging prices.

The central bank also raised the cash buffer that banks are required to hold, which is expected to push up short-term rates in the market.

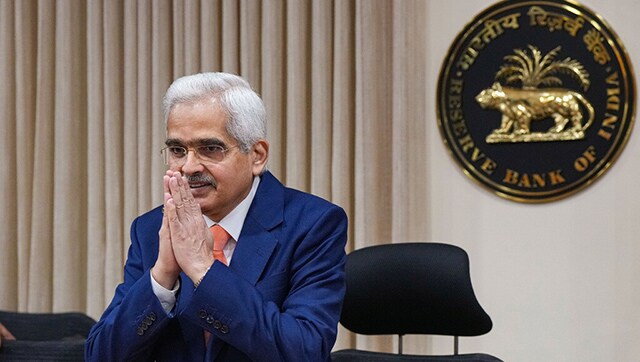

RBI Governor Shaktikanta Das said that the RBI maintained its policy stance of “withdrawal of accommodation” to ensure inflation progressively aligns with the committee’s target while remaining supportive of economic growth.

Five of six committee members voted in favour of the stance, he added.

“Liquidity plays a major role with regards to inflation – both in pushing up inflation and controlling inflation,” Das said, explaining the decision.

“While inflation has moderated, the job is still not done,” he said.

What does this mean for inflation?

The central bank predicts inflation will go up.

The central bank raised its inflation forecast for the current financial year to 5.4 per cent from 5.1 per cent earlier, citing pressures from food prices.

In the July-September quarter, it now sees inflation at 6.2 per cent, significantly higher than the 5.2 per cent earlier forecast.

Monetary policy can look through food price shocks for some time, Das said.

“We do look through idiosyncratic shocks but if it shows signs of persistence, we have to act.”

Food price spikes in India, typical at the onset of the monsoon, drove up headline inflation in June, snapping a four-month downward trend. Analysts expect inflation to have reached 6.4 per cent in July, moving out of the RBI’s 2 per cent- 6 per cent comfort band.

The central bank took comfort in the fact that core inflation, which excludes volatile food and energy prices, has softened.

What do experts say?

A piece in the Deccan Chronicle argued that the RBI was left with a difficult choice.

“The dilemma of the RBI was understandable. It is not just the RBI; the broader markets have been in a dilemma. Policy experts have long warned of the impact of rising rates on expanded balance sheets. However, despite the ever-increasing debt and interest rate levels in the United States, the markets have been rallying,” the piece stated.

The piece stated that though global central banks have continuously raised rates to tamp down inflation, inflated balance sheets and increased rates have combined for a significant increase in the interest expense outflow.

“The sustainability of this growing interest expense, particularly for the US has been called into question since the US Fed started tightening. The US Fed’s own expectations is for rates to rise to 5.6 per cent this year before gradually beginning to ease. The jury is still out on whether the market rally is due to the inherit strength of the economy (as claimed by the central banks) or is the market’s attempt to price in the impending rate cuts. However, what is clear is that the music cannot last for very long,” the piece argued.

An editorial in The Hindu argued that the RBI had taken a ‘calculated risk’ – particularly in view of its own increased inflation forecast.

“….while Mr. Das and his colleagues on the MPC have reaffirmed their readiness to take policy actions in order to align inflation to the target and ensure that inflation expectations remain well anchored, how quickly policymakers actually walk the talk and intercede in the coming months will determine their inflation-fighting mettle,” the piece contended.

An article in CNBC said the RBI had taken a ‘balanced approach’.

“Looking ahead, a prolonged pause may be the path of least resistance for the RBI. Lowering rates at this stage could prove premature given near-term inflation risks and hawkish US Fed and ECB, while tightening further could hurt sentiments when lagged impact of past tightening is still working through the economy,” the piece stated.

An article in Indian Express said the decisions taken by the RBI would shore up the building blocks of an already resilient Indian economy that is ready to withstand any external shocks.

“The global macroeconomic environment remains uncertain. Central banks in advanced economies are continuing to raise rates amidst a sticky inflationary environment, characterised by uncertain signals from noisy job markets. This is creating its own complications, including the fast-vanishing arbitrage between jurisdictions,” the piece stated.

The article stated that while the upward revision is a matter of concern, the impact is likely to be brief.

“In fact, after the jump in inflation in July and August to beyond 6.5 per cent, the fall is likely to be just as rapid from September onwards with inflation trending towards 6 per cent and below. Also, the likely decline in core inflation towards 5 per cent is a matter of great comfort, as empirical research suggests that headline inflation in India reverts to core inflation and not the other way around,” the piece stated.

Upasana Bhardwaj, chief economist at Kotak Mahindra Bank, said, “We believe the seasonal uptick along with erratic weather conditions will continue to keep the hawkish bias of the MPC intact in the upcoming meetings as well,”

“However, we expect rates to remain unchanged through the rest of the year.”

The expected rise in inflation and steady growth had prompted swap markets to price in the probability of one more rate hike from the central bank.

“We doubt that further hikes will materialise,” said Capital Economics.

“But with the El Nino threat lurking … there is a growing risk that the RBI delays the (policy) loosening that we currently expect to begin in early 2024 even as other major emerging economies kick off their easing cycles,” Shilan Shah, deputy chief emerging markets economist at the research house, said in the note.

Growth in the Indian economy is seen at 6.5f, unchanged from the RBI’s previous forecast.

“Demand in the economy remains buoyant,” said Das.

The benchmark 7.26 per cent 2033 bond yield was trading at 7.166 per cent as of 1:00 p.m. IST, down marginally, while the rupee was flat at 82.81 against the dollar.

The BSE Sensex was down 0.26 per cent, while the broader NSE stock index was down 0.23 per cent for the day.

With inputs from agencies

also read

What's Udupi college washroom video row? Why is BJP demanding SIT probe?

An FIR has been registered against three women at a Karnataka college for purportedly filming a fellow student in the bathroom. The BJP is demanding the arrest of the students and a SIT probe after some right-wing groups have claimed the incident is part of a ‘larger conspiracy’

Mumbai-Goa highway set to open next month: What do we know about NH-66?

Work on the Mumbai-Goa Expressway, which has been ongoing for more than a decade, is expected to reduce travel time between the two cities by six hours. Authorities say it will provide commuters a safer route and boost tourism

How Instagram is making people bad tourists

People are likely to act more hedonistically while on holiday. Now, travellers also look to social media for proof of how others behave. If their peers from home are throwing caution to the wind while on holiday, this can cause a domino effect of bad behaviour